Wisconsin tax collections down 2.9% in March

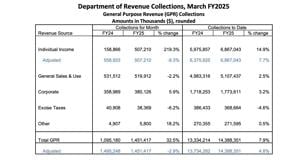

(The Center Square) – Wisconsin general purpose tax collections were down 2.9% in March from a year ago, based on adjusted numbers from the state’s Department of Revenue.

Wisconsin remains 4.8% ahead of last fiscal year through the first nine months, collecting nearly $14.4 billion compared to $13.7 billion at this point a year ago.

A key indicator in the numbers remains sales and use taxes in the state. Those collections were down year-over-year in March with nearly $520 million collected compared to nearly $532 million in March 2024.

Wisconsin has collected $5.1 billion in sales and use taxes for the fiscal year compared to nearly $5.0 billion a year ago at the same point.

Individual income tax collections are up 7.7% for the fiscal year, corporate tax collections are up 3.2% and excise tax collections are down 4.6% for the fiscal year.

“Individual Income includes 53.9% of pass-thru withholding,” the Department of Revenue said. “Corporate Income includes the remaining 46.1%.”